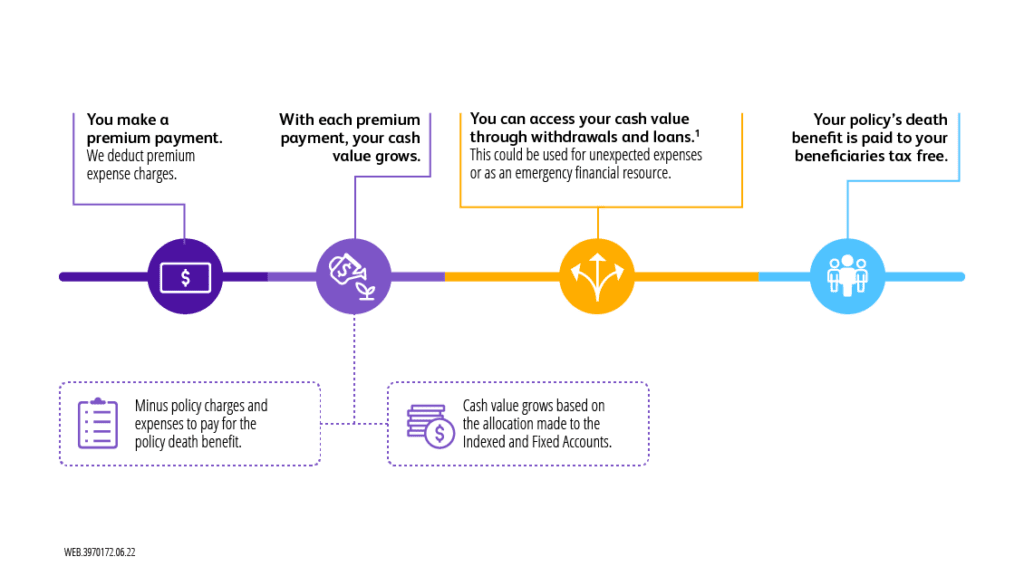

A portion of the premium payments made by the policyholder goes toward building the cash value, which grows on a tax-deferred basis. The cash value can be accessed during the policyholder's lifetime through policy loans or withdrawals, offering a source of tax-advantaged savings.

Returns on IUL policies are typically based on the performance of a specified stock market index, such as the S&P 500. If the index performs well, the cash value can increase accordingly, up to a cap or with a participation rate. However, there is often downside protection to safeguard against market losses.

Yes, IUL policies typically offer downside protection. If the chosen index performs poorly or experiences negative returns, the policy's cash value is generally protected from market losses. This helps maintain stability and protection for the policyholder.

Yes, many IUL policies offer flexibility in premium payments. Policyholders can often adjust the amount and timing of their premium payments within certain limits, allowing them to adapt to changing financial circumstances.